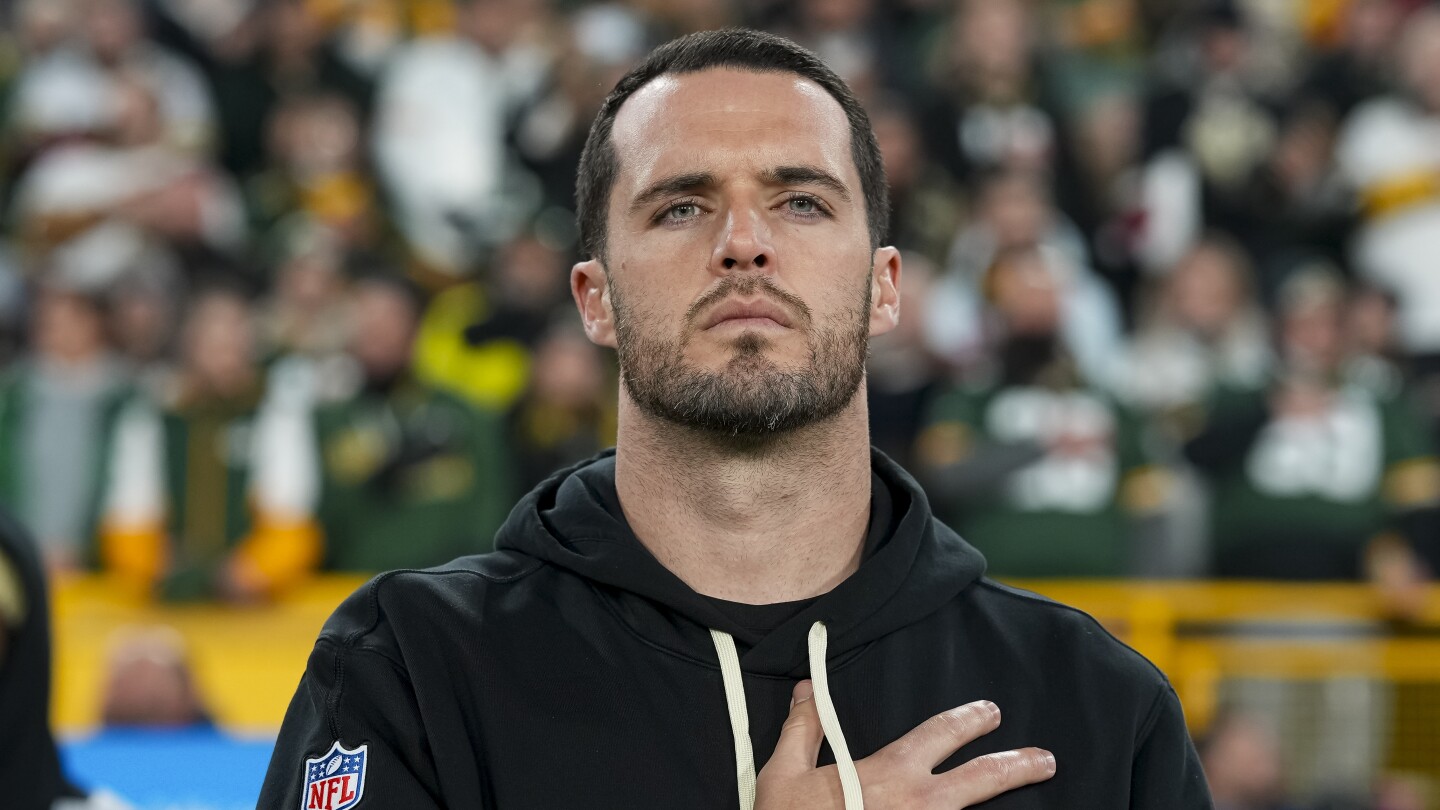

The Saints are doing what the Saints do, pretty much every March. They’re turning a seemingly unfixable cap crunch into far smoother sailing.

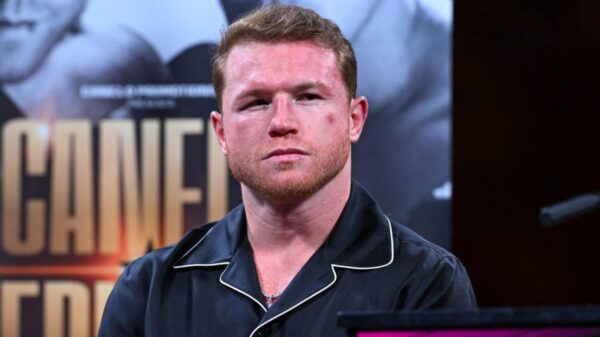

Saturday’s move to create $30.996 million in cap space was the result of the team exercising its absolute contractual right to convert all but $1.255 million of Carr’s 2025 compensation into a signing bonus. Carr didn’t agree to it; his agreement wasn’t required.

That’s $38.745 million ($40 million minus $1.255 million) divided by five (the number of years that it will be prorated) times four (the number of years that will be pushed forward).

The move adds $7.749 million to Carr’s existing 2026 cap number of $61.458 million, pushing it to a whopping $69.207 million. But he’s due to make $50 million next year. If/when (when) the Saints tear up the contract, those cap dollars will disappear.

They’ll still have $46.221 million to absorb, at some point. Beyond the $19.207 million in dead money for 2026. That’s $65.428 million in post-2025 dead money for the Saints, flowing directly from the Carr contract.

The only viable alternative was to cut Carr. He wasn’t going to take less. He now gets $38.745 million right now, with another $1.255 million to come in 2025. If he stays with the Saints after 2026, it most likely won’t be under the remaining terms of his current contract.

Read the full article here